Finding the Best Credit Repair Software in 2024

In the financial landscape of 2024, managing and enhancing one’s credit score has never been more crucial. With the advent of credit repair software, individuals and businesses alike have a powerful tool at their disposal to navigate the complex terrain of credit scores. This guide aims to illuminate the essential role these software solutions play in unlocking financial opportunities by improving credit scores. Over the years, the software evolution has significantly impacted how people manage their financial health, moving from manual interventions to automated, sophisticated systems. As we delve into this ultimate guide, we will explore the criteria for selecting the top credit repair software, ensuring you have the knowledge to make an informed decision.

Credit repair software is more than a convenience; it’s a necessity for those looking to enhance their financial standing. A good credit score opens doors to numerous financial opportunities, from lower interest rates on loans and credit cards to favorable terms on various financial products. The evolution from simple, manual tracking tools to comprehensive, automated systems has revolutionized credit score improvement, making it accessible to a wider audience. This guide will preview the top software of 2024, focusing on features like user-friendliness, customization, and integration capabilities, which are crucial for effective credit management.

Features to Look for in Credit Repair Software

When selecting the best credit repair software, there are several key features to consider that can significantly enhance the user experience and effectiveness of the software. Firstly, user-friendly interfaces are crucial. They not only make navigation simpler for users but also reduce the learning curve, enabling individuals to start improving their credit scores without extensive technical know-how. Secondly, customization options are vital. Given the diverse nature of credit issues and personal financial goals, software that allows users to tailor its functionality to their specific needs stands out as particularly valuable. Thirdly, software integration with other financial tools and platforms can dramatically improve efficiency, allowing for a seamless flow of information and a more holistic approach to financial management.

These features collectively contribute to the utility and effectiveness of credit repair software, making the selection process critical for users. User-friendly designs ensure that individuals can easily navigate the software, customization options allow for a personalized credit repair experience, and software integration facilitates a comprehensive approach to financial health by working in tandem with other financial tools and platforms.

Top 5 Credit Repair Software of 2024

A. DisputeBee

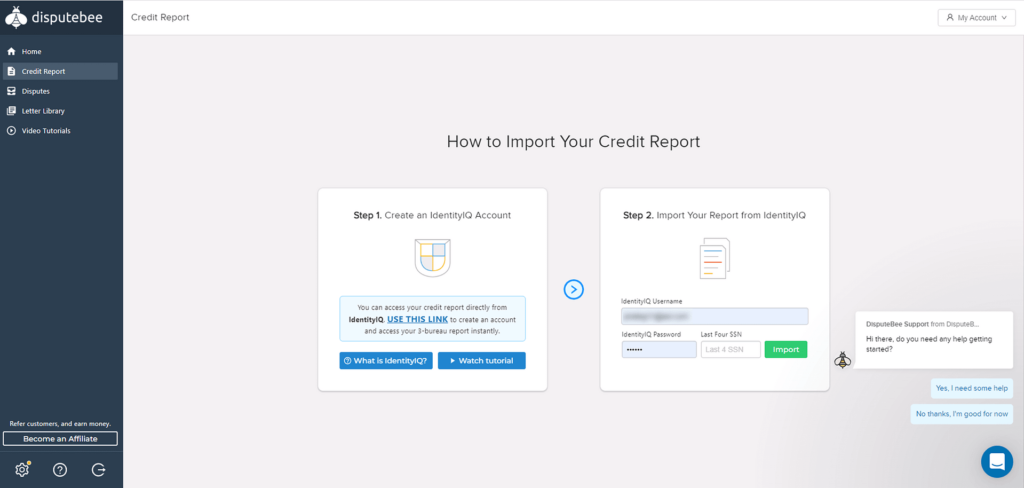

DisputeBee automates the dispute process, streamlining the interaction with credit bureaus. Its focus on simplifying the letter-sending process, coupled with educational resources, empowers users with the knowledge and tools needed for effective credit repair. The streamlined interface enhances efficiency, making it easier for users to manage their disputes and track progress.

Automation is a key feature of DisputeBee, reducing the complexity and time involved in disputing errors on credit reports. By providing educational resources, it also ensures that users are well-informed about the credit repair process, further enhancing the effectiveness of their efforts. The user-friendly and efficient interface of DisputeBee makes it a valuable tool for those looking to actively engage in improving their credit score.

Check out our in-depth guide on Dispute Bee here

Key Takeaways:

Automated Dispute Process: Simplifies the letter-sending process to credit bureaus, making the dispute management more efficient.

Educational Resources: Offers resources for a better understanding of credit repair.

Streamlined Interface: Designed for efficiency, making the software user-friendly.

B. Credit Detailer

Credit Detailer stands out as an affordable and user-friendly software option, catering to both beginners and professionals in the credit repair space. It offers bilingual support, making it accessible to a wider user base beyond English-speaking individuals. This software simplifies the credit repair process, providing tools and resources that are easy to understand and use, thus democratizing access to credit improvement.

For individuals looking for an entry point into credit repair or professionals seeking a reliable tool, Credit Detailer offers a blend of accessibility and functionality. Its bilingual support breaks down language barriers, ensuring that more users can take advantage of the opportunities for affordable credit repair. By catering to a diverse audience, Credit Detailer underscores the importance of inclusivity in financial tools.

Key Takeaways:

Free Demo & 30-Day Refund Policy: Credit Detailer offers a free trial and a no-questions-asked refund policy within 30 days, providing a risk-free opportunity to test its features.

Credit Coaching Options: The software includes access to credit coaching, adding value for users looking to understand the credit repair process better.

Unlimited Clients Support: Particularly beneficial for professionals, allowing them to manage an unlimited number of clients without additional costs.

Bilingual Software (Spanish & English): This feature makes the software accessible to a broader range of users and clients.

Comprehensive Educational Resources: Credit Detailer provides an extensive education center full of guidance, tips, and tricks at no extra cost, supporting both personal and professional users.

C. Credit Repair Cloud

As a market leader, Credit Repair Cloud offers an extensive feature set designed to cater to the needs of credit repair businesses. It is a cloud-based software, enabling easy access and collaboration, and comes equipped with a complete business suite for managing and scaling credit repair operations. Its comprehensive offerings make it a standout choice for professionals in the industry.

Credit Repair Cloud is not just a tool but a platform that supports business growth and operational efficiency. The cloud-based nature allows businesses to operate remotely, providing flexibility and scalability. Its comprehensive business suite is designed to handle the nuances of credit repair, making it a preferred choice for those looking to professionalize and expand their services.

Key Takeaways:

Full Business Software Solution: Offers more than just credit repair software, including a client portal, KPI dashboard, CRM system, live support, and education resources

Savings on Annual Plans: Provides an incentive for long-term commitment with discounted pricing on annual subscriptions

Unlimited Storage: Allows for extensive client data management without worrying about running out of space

Client Portal Feature: Enhances customer service by allowing clients to stay informed about their case status

Customizable Plans: With four base plans and optional add-ons, Credit Repair Cloud can be tailored to the specific needs of your business

D. ScoreCEO

ScoreCEO offers a comprehensive toolset focused on client management and business growth. Its advanced features, including training and resources for users, along with advanced reporting capabilities, make it a robust choice for credit repair businesses aiming to scale operations and improve client outcomes. The emphasis on education and data analysis sets ScoreCEO apart in the market.

With a strong foundation in supporting business development, ScoreCEO addresses the needs of credit repair businesses at various stages of growth. Its advanced reporting features offer deep insights into client progress and business performance, facilitating informed decision-making and strategic planning. The provision of training and resources ensures that businesses can not only use the software effectively but also stay updated on best practices in credit repair.

Key Takeaways:

Scalable: The software is reliable and scalable, fitting businesses of any size

E. TurboDispute

TurboDispute provides a web-based solution that’s accessible from anywhere, making it ideal for individuals and businesses embracing remote work. Its integration with credit report providers simplifies the import process, and custom dispute letter templates make it easy to address inaccuracies on credit reports. This software combines convenience with functionality, offering a comprehensive tool for credit repair efforts.

The ability to work remotely has become increasingly important, and TurboDispute leverages this trend by offering a web-based solution that is accessible from any internet-connected device. This flexibility, combined with features like credit report integration and dispute templates, makes TurboDispute a valuable asset for anyone looking to improve their credit score efficiently and effectively.

How to Choose the Right Credit Repair Software for You

Choosing the right credit repair software involves matching the software’s features with your personal or business needs. Budget consideration is a crucial aspect, as software pricing models vary widely. Additionally, the quality of customer service and support offered by the software provider can significantly impact user experience and success. Assessing the scalability of the software is also important, especially for businesses that plan to grow over time.

Understanding your needs and priorities is the first step in selecting the right software. Whether you’re focused on affordability, comprehensive features, or support for business expansion, there’s a solution that fits

. Considering software selection from the perspective of budget, customer support, and future needs ensures that you choose a tool that will serve you well in the long term.

Conclusion

As we conclude this guide, it’s clear that the right credit repair software can significantly empower individuals and businesses to take control of their financial health. The evolution of these tools has made credit score improvement more accessible than ever, offering features like user-friendly interfaces, customization options, and software integration. By carefully considering your needs and the features offered by each software, you can make an informed decision that aligns with your financial empowerment goals. Remember, the journey to improved credit is a step towards greater financial opportunities and freedom. Choose a software that fits your needs, and take that step today.

To explore more content like this, we invite you to visit our homepage, where a diverse range of blogs on various software solutions awaits you.

What is credit repair software?

Credit repair software is a digital tool designed to help individuals and businesses manage and improve their credit scores through a variety of functions, including dispute management, credit monitoring, and educational resources.

Why is a good credit score important?

A good credit score can unlock numerous financial opportunities, such as lower interest rates on loans and credit cards, better terms on financial products, and increased borrowing power.

Can credit repair software integrate with other financial tools?

Yes, many credit repair software solutions offer integration capabilities with other financial tools and platforms, allowing for a seamless management of personal finances and more effective credit repair efforts.

Is credit repair software suitable for beginners?

Absolutely. Many credit repair software options are designed with user-friendly interfaces that make them accessible and easy to use for beginners, with comprehensive guides and educational resources to support their journey.

Pingback: Dispute Bee Review 2024: Success Stories and Untold Experiences - SoftwareSpectrum360